personal loan malaysia bank islam

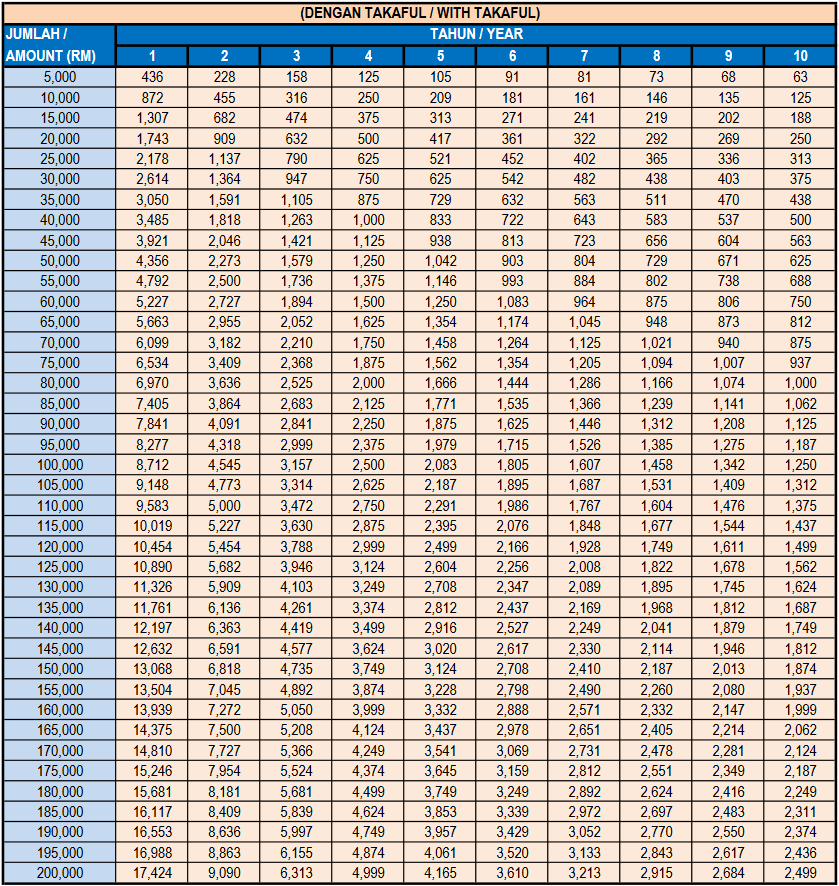

Our loan application assistance solutions cover all kinds of loans including loans for personal use proprietorship partnership and private limited company loans. Up to 11 with amount of salary credited to Bank Islam and up to maximum of RM5000000.

Personal Loans Vs Home Loans In Malaysia By Aysha Maria Issuu

Get approval within 24 hours.

. Tenure over 2 years Monthly Repayment RM45167. Compare and get an Islamic personal loan with interest rates as low as 32. Personal Loan Bank Islam.

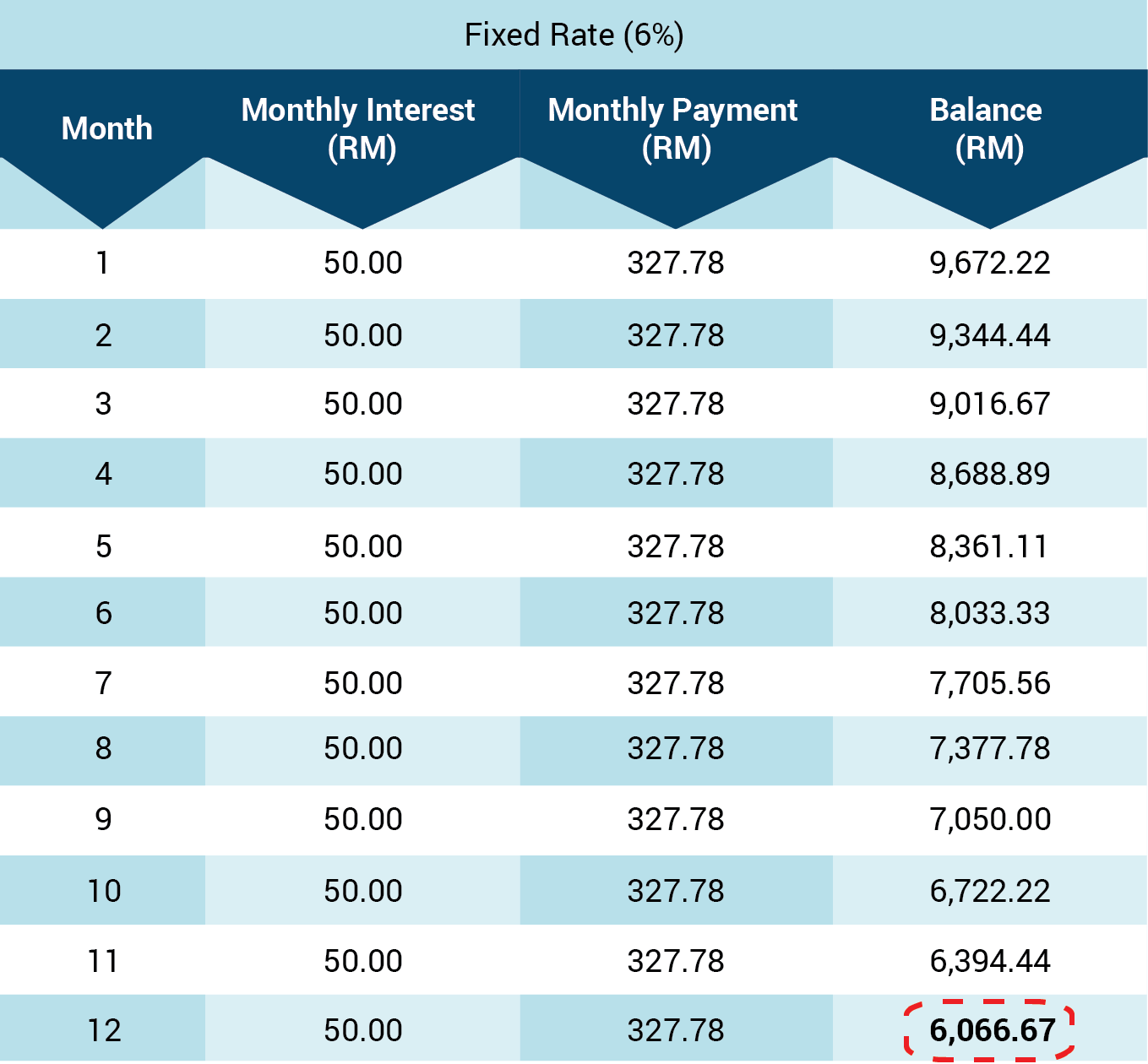

Bank Islam Floating Rate Personal Financing-i Package Profit Rate from 492 pa. Bank Islam Flat Rate Personal Financing-i Package Profit Rate from 42 pa. What happens is the Islamic personal loan is treated as a product or an asset.

In Islamic financing the borrower will repay the bank a fixed monthly rate inclusive of the markup instead of an interest rate as is used in conventional personal loans. We are connected with banks like RHB Citibank Maybank AmBank BSN Agro Bank CIMB Affin Bank Bank Rakyat Bank Muamalat AEON Alliance Bank Bank Islam and more. 1 3 years.

Finance your solar PV system with Bank Islam today. Personal Financing For Professional Program. According to Shariah law one cannot charge any interests when giving a loan.

Personal Financing-i Non Package. SBR 605 pa Profit is calculated on a daily basis based on Monthly Rest Note. Tenure over 2 years Monthly Repayment RM49167.

BuySolar Malaysia Financing Bank Islam Personal Loan. Prime Lending offers all-inclusive loan application assistance for personal business SME housing and debt consolidation loans. Salary deduction salary transfer to Bank Islam with auto-debit instruction standing instruction Personal Financing for Professional Program What are the documents required for Bank.

Profit is calculated on a monthly basis based on Sum of Digit 4 8 years. They are geared towards meeting societys financial needs in the most sustainable and ethical manner possible staying anchored on the Shariah rules and principles. 1-3 years.

Bank Islam Debit Card-i. Let our loan experts help. Form.

Tenure over 2 years Monthly Repayment RM45767. Hong Leong Islamic Personal Financing-i Profit Rate from 9 pa. Let our loan experts help you get the funds you need when you need it.

Islamic personal loans also known as an Islamic personal financing is issued by Islamic banks in Malaysia. So to adhere to this concept no money is involved in Islamic personal loan. Personal Financing For Professional Program.

Bank Islam Debit Card-i. SBR 415 pa Profit is calculated on a daily basis based on Monthly Rest 4-10 years. Up to 100 if secured against fixed deposit.

Profit is calculated on a monthly basis based on Sum of Digit 9 10 years. Prime Lending offers all-inclusive loan application assistance for personal business SME housing and debt consolidation loans. Bank Islam Flat Rate Personal Financing-i Package Profit Rate from 42 pa.

Bank Islam Floating Rate Personal Financing-i Package Profit Rate from 492 pa. Tenure over 2 years Monthly Repayment RM49167. Use the Islamic personal loan calculator to check for your monthly repayments and apply online for free.

Personal Financing-i Non Package. Form. The financing tool uses the concept of Bai Al-Inah making it Shariah compliant.

Tenure over 2 years Monthly Repayment RM45767. Bank Islam Personal Financing-i Packageis a personal loan for Malaysian citizens thatare looking for a high financing amount of up to RM 300000. Bank Islam is the pioneer of Islamic banking in Malaysia.

Tenure over 2 years Monthly Repayment RM45167. Bank Islam Credit Card-i. Bank Islam personal loans can provide you with the following benefits.

Personal use including your kids education fund. Address gaps in your finances by applying for the right loan in Malaysia. Flexible repayment tenure up to 10 years.

Up to 80 if secured against structured investment. Address gaps in your finances by applying for the right loan in Malaysia. Bank Islam Credit Card-i.

It also has a relatively low installment and decent financing with a relatively low gross income requirement. SBR effective 1 August 2022 is 225 pa. Being Shariah compliant means the loan does not have fixed or floating interest rates or fees also known as riba or usury for the loan of money.

Simply put the markup replaces the interest rate Riba which is prohibited in Islamic banking. Hong Leong Islamic Personal Financing-i Profit Rate from 9 pa. No guarantor is required.

Up to 60 if secured against unit trust.

Bank Rakyat Personal Loan Hot Sale 54 Off Ilikepinga Com

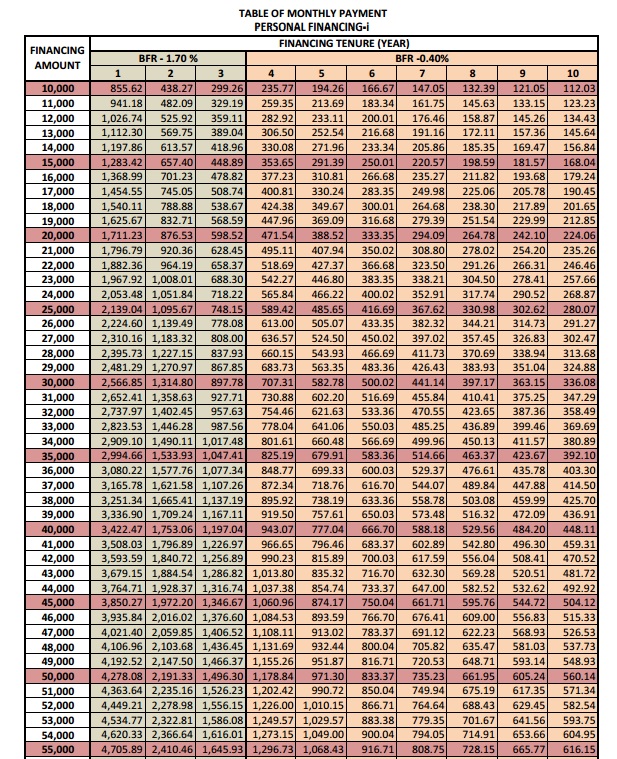

Bank Islam Personal Loan Monthly Repayment Table Otosection

Personal Loan Bank Koop Photos Facebook

Personal Financing Bank Islam Malaysia Berhad

Personal Loan Bank Koop Photos Facebook

Bank Islam Personal Loan Repayment Table Pdf Monetary Reform Financial Services

How To Refinance Your Personal Loan

Top Tips On How To Pay Back Your Personal Loan Personal Loan Cost Expense Expenses Debt Living Debt Bank Saving Save Cr Personal Loans Person Loan

Islamic Bank Personal Loan Malaysia

Bank Rakyat Personal Loan Hot Sale 54 Off Ilikepinga Com

Personal Loan Bank Koop Photos Facebook

Bank Rakyat Personal Loan Hot Sale 54 Off Ilikepinga Com

Bank Rakyat Personal Loan Hot Sale 54 Off Ilikepinga Com

Bank Rakyat Personal Loan Hot Sale 54 Off Ilikepinga Com